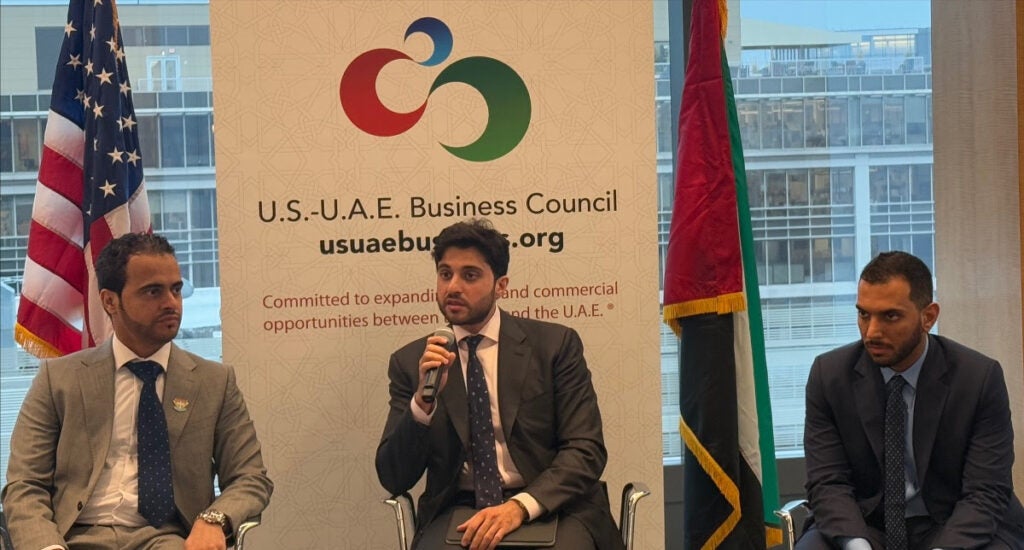

The U.S.-U.A.E. Business Council hosted a roundtable briefing on Tuesday, December 10th in Washington, D.C. with a delegation led by His Excellency Hamid Al Zaabi, Secretary General of the General Secretariat of the National Anti-Money Laundering and Combating Financing of Terrorism and Financing of Illegal Organizations Committee (NAMLCFTC). The delegation of officials representing six U.A.E. government agencies is in the United States to engage both public and private U.S. stakeholders and explain the U.A.E.’s progress in strengthening its Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT) regime.

His Excellency Al Zaabi and his team highlighted this week’s announcement of the establishment of the General Secretariat of NAMLCFTC as a federal authority. Mohamed Jawad Shalo, Director of Communication & Strategic Partnerships Department, listed the three priorities of the General Secretariat: national risk assessment and policy development, national coordination and follow-up for U.A.E. government agencies, and strategic partnerships to address global financial crime. The General Secretariat has a wider mandate to address evolving AML/CFT challenges and risks through informed policy development.

His Excellency and the delegation discussed the U.A.E.’s National Strategy for Anti-Money Laundering, Countering Financing of Terrorism and Proliferation Financing for 2024-27, adopted earlier this year. His Excellency stated the U.A.E.’s goal is to establish an AML/CFT system that facilitates and promotes a safe business environment in the U.A.E. and contributes to global financial security. Mohamed Said Alkatheeri, Director of National Coordination & Follow Up Department, outlined the 11 strategic priorities of his department to enhance regulatory and supervisory systems, aligned with global standards and best practices. These priorities revolve around national risks, international engagement, enhancing the U.A.E.’s supervisory framework, beneficial ownership, financial intelligence, financial sanctions, and more.

His Excellency characterized these measures as initiatives aimed at improving transparency, sustainability, promoting international collaboration on AML/CFT standards and practices, and bolstering financial intelligence capabilities. He added that these efforts are designed to propel the U.A.E. as a global leader in the fight against financial crimes and illicit financial flows. Mr. Alkatheeri asserted that these strategies will not hinder the U.A.E.’s competitive and attractive business environment but would rather bolster further investment and business collaboration.

His Excellency and his team underscored the need for public-private partnerships, particularly strategic relationships between the U.A.E. government and the U.S. private sector. They provided an update on the work of the Public-Private Partnership Sub-Committee including its pivotal role in enhancing dialogue with the private sector and the latest public-private partnership initiatives that are supporting government action. This committee not only includes private sector representation from the financial sector but also from various other sectors such as professional services crucial to AML/CFT.

His Excellency and his team also addressed the challenges posed by emerging financial crime trends, particularly those related to AI and virtual assets. Dr. Ebrahim Hamden Alakeem, Director of National Risks & Policies Department, outlined the opportunities that will arise as it relates to traceability of beneficial ownership in the digital world, including AI’s ability to assess and predict risk patterns.

For any questions about this event, please contact Caitlin Cottrell at ccottrell@usuaebusiness.org.